By participating in decentralised networks, trust must be established despite participants being geographically dispersed and unknown to one another. Employing consensus mechanisms to record transactions on a public ledger can achieve this.

The computational-heavy and electricity-intensive nature of blockchains that use proof of work (‘PoW’) as their consensus mechanism, most notably the Bitcoin blockchain, has led to other blockchains adopting proof of stake (‘PoS’) and delegated proof of stake (‘DPoS’) as their consensus mechanisms of choice.

What Is Staking?

PoS involves tokens being withheld on a blockchain to validate transactions, therefore supporting the security and operations of a blockchain.

“The digital assets (coin/tokens) serve as security collateral in crypto networks.”[1]

Stakers help secure and operate a PoS blockchain by staking assets ‘on-chain’ via a node. (A node is a participant in a blockchain network that communicates with other nodes to ensure its security and integrity.)

Block validators are randomly selected to append a new block to the blockchain. Generally speaking, the more tokens staked, the greater the chance that they are selected to validate new blocks. Stakers are compensated in native token-denominated rewards. They are financially incentivised to stake because if they did not, then their holdings would dilute due to new tokens constantly adding to supply.

Different blockchains refer to stakers in different ways. They are called validators in Cosmos and Ethereum 2.0, bakers in Tezos, and block producers in EOS, among others.

What Are Staking Rewards?

As of Q1 2021, newly minted tokens are rewarded to validators for the creation of new blocks. Total circulating support increased with each token minted.

In this way, block rewards are not derived from the earnings of the blockchain, but more so from increasing token supply. This token supply inflation mechanism has the potential to dilute investors and is a short-term mechanism to grow a nascent blockchain into a thriving ecosystem. Staking returns are a type of seigniorage that accrues to stakers via inflation in the coin supply.

Block rewards depend on each blockchain and what factors they take into account. For example, a blockchain may consider the staking amount (asset-weighted), duration of staking (time-weighted), and inflation rate. Rewards can be fixed or variable, and can be denominated in the blockchain’s native token or a secondary token.

Other forms of rewards validators can earn include gas or transactions fees (computation fees), network taxes and seigniorage rewards based on the current token price and the cost of minting and distributing a newly minted asset.

How to Stake

To stake, token holders either send tokens to a certain smart contract address or hold their tokens in a certain wallet. However, there are many choices in tokens to stake and unique rules of staking for each blockchain.

For example, staking can be seen as a savings account from a bank that also helps secure the bank as collateral.

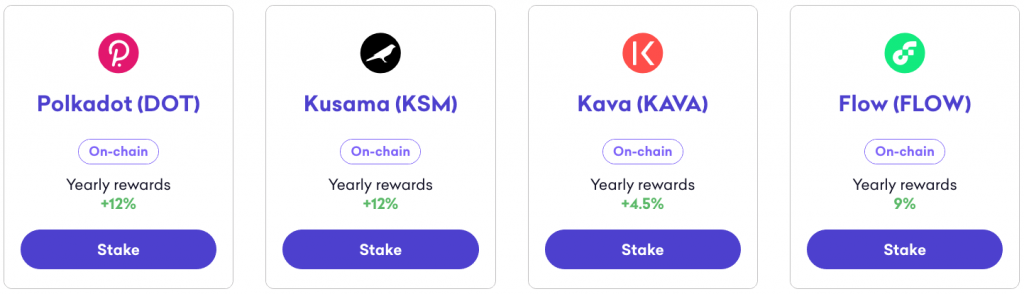

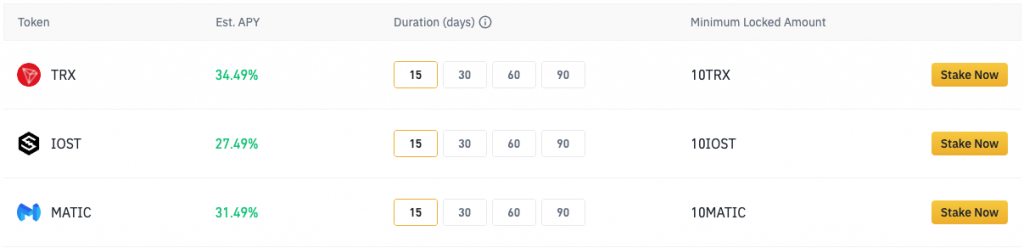

Centralised exchanges (CEXes) offer staking services where investors are typically required to deposit tokens into a ‘vault’ or simply hold the tokens on the exchange.

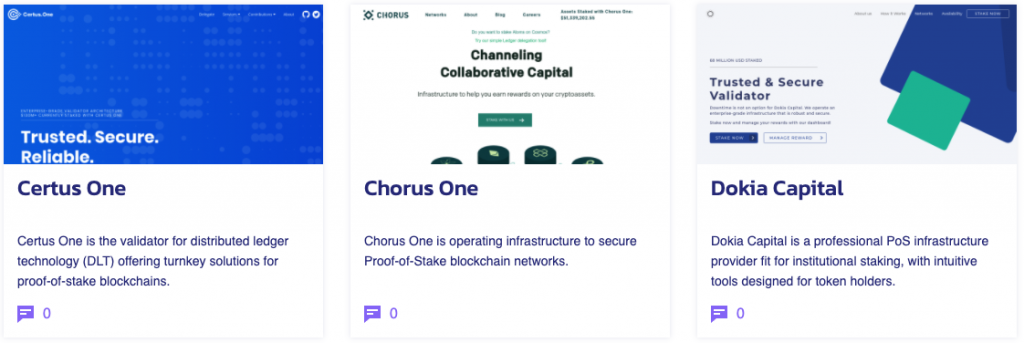

Staking service providers operate ‘staking pools’ and provide ‘staking-as-a-service’ by running nodes for decentralised PoS protocols on behalf of investors, ensuring investors can participate in the security (and yield) of the network without the time and technical demands of running a node.

By pooling funds, this increases the chance it is selected for transaction validation. This is because the probability of your node being selected to create the next block is proportional to the size of the node’s stake relative to the total amount staked in the network. Staker service providers charge a service fee.

Staking Practises

Self-custody staking using a Web3 wallet like Ledger enables token holders to receive staking rewards while simply holding the tokens in their wallet.

Operating a validator node and staking tokens on their own node is an option for the technically competent and time-committed.

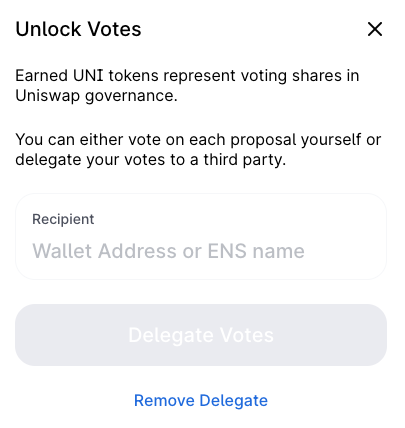

Governance staking involves locking your tokens into the governance vault of a given organisation, or holding your tokens and using them to vote on improvement proposals. Because one vote typically equals one vote, large token holders have a disproportionate influence on the organisation’s direction—relative to if one address equalled one vote.

Risks of Staking

Whilst staking can be likened to depositing assets into a bank savings account, the additional duties required of a validator are more stringent than that of a bank depositor.

Operationally, if the validator exhibits bad behaviour or fails to participate in governance, they are punished, typically through slashing the amount of staked tokens, which in some instances can also punish delegated stakers through loss of funds.[5]

Counterparty risk arises if investors delegate their tokens to a staking service and therefore delegate control of their tokens. This act exposes investors to the risk that service providers may default on the required payment of a validator, who may also be uninsured or unincorporated, leaving the investor with little recourse. Selection of a competent and trustworthy validator is essential.

Stakers and delegators are exposed to the risks of maintaining a long-term position in volatile and highly fluctuating assets. Staking rewards therefore provide incentives to keep long-term interest in ownership of the blockchains token despite this volatility.

The yield % rewarded through staking should consistently be compared to yields investors can realise by lending that same token in the open market. If on-chain lending rates are consistently higher than the rates of on-chain staking, funds may move from staking to lending and thereby decreasing network security. Block rewards need to be calibrated above on-chain lending rates to ensure PoS network security.