Everyone likes to make their money work for them and earn yield, especially when cryptocurrency platforms offer more competitive rates versus a traditional bank.

There’s a range of ways to earn yield in cryptocurrency, and it depends on your risk tolerance. This post focuses on yield options available on centralised crypto lending platforms.

I hope this post can serve as a learning opportunity for members and encourage everyone to share how you earn yield from lending via centralised or custodial platforms.

A Recap: What Is Crypto Lending?

With historically low-interest rates, a growing number of people are lending out their cryptocurrency to earn interest.

I encourage members who want to learn more about cryptocurrency yield and lending to read our Resource on What is Crypto Lending?

In short, it’s essential to understand the difference between custodial vs non-custodial lending platforms.

- Custodial lending platforms = Users entrust their cryptocurrency with the business that runs the platform. Those who use these platforms are essentially transferring their ownership to the business that operates the lending platform.

- Examples: BlockFi, Coinbase, Gemini or Celsius.

- Non-custodial lending platforms = Users maintain custody of their cryptocurrency, removing counterparty risk. These types of lending platforms are more vulnerable to being hacked through smart contract exploitations.

- Examples: Aave or Compound.

This post will be looking at custodial options via centralised platforms or exchanges.

Comparison

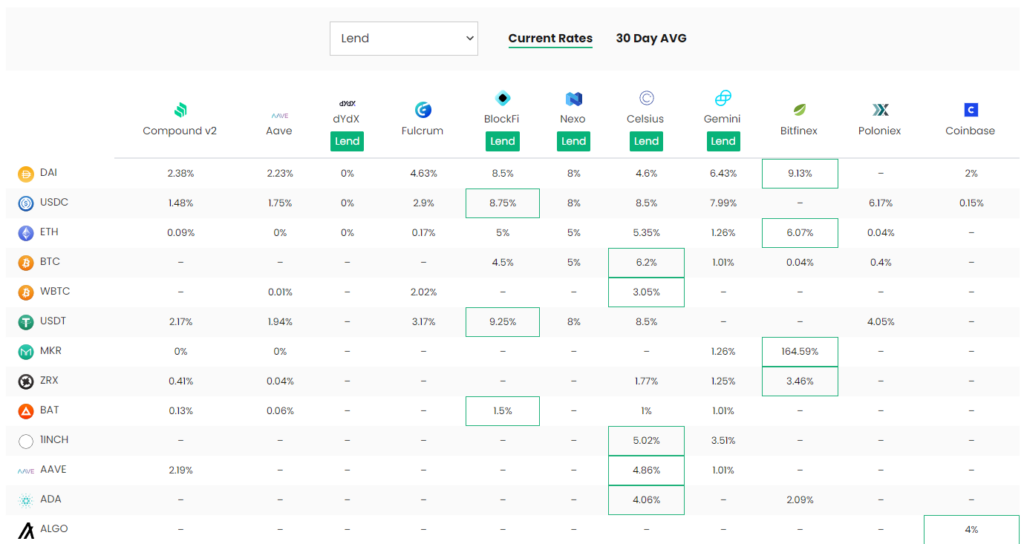

If you are interested in earning yield through lending your cryptocurrency via centralised platforms, check out the comparison table below. For total rates and crypto assets supported, click through at the appropriate links. Rates are the standard yields for USDC.

*It’s important to understand that rate will change depending on the asset, amount of cryptocurrency and whether it is locked or not.

Table accurate as of Feb 22. 2022.

Other lending platforms include CoinLoan, Holdnaut or Swissborg, but in my personal, these could be riskier than the above platforms.

Compare The Best Rates

DeFi Rate Lend can be a handy tool to track down the best crypto lending interest rates.

Other fantastic tools include:

Are Custodial Lending Platforms Risk Free?

It’s essential to remember these platforms are not risk-free, and users should understand the risks of lending out your cryptocurrency. Risks include:

- Often not FDIC insured: Your funds on an exchange may not be as protected via insurance, compared to a regular bank account. Each lending platform will have a different insurance policy or may not have one at all. This is important to verify.

This can be a positive compared to DeFi as most of the time DeFi protocols have no insurance in place for users and it’s the individuals’ responsibility. - Platform risk, may not be as ‘safe’ as a bank: i.e. if the platform turns out to be fraudulent, badly managed, faces liquidity issues or shuts down.

These platforms lend out your cryptocurrency further—they could face issues if they are lending out your cryptocurrency to riskier lenders or cant service debt. - Limits on withdrawals: There could be limits when you can and cant withdraw your cryptocurrency.

- Depends where you live: Especially for U.S. residents, you may be limited in which of these services you can legally use or participate in.

- Centralisation: Using a centralised lending platform you are trusting your cryptocurrency with a third party. This means you may no longer retain your cryptocurrency, as opposed to keeping control of your private keys when using a DeFi platform.

Questions to ask

- Which assets are supported? Celsius, Gemini and Binance offer a higher range of crypto assets, each platform will be different. See the above table on supported assets.

- Are your funds insured? As stated, not all lending platforms have conclusive insurance in the event of a hack or shutdown.

- How is your interest paid? Gemini offers daily rewards, whereas others like BlockFi payout monthly. This could impact your decision.

- Is the yield term locked or flexible? Platforms will have different rates depending on (i) how long you loan for (ii) if the funds are locked over a set period time. APY (annual percentage yield) will often change and may not be locked in.

For example, Binance Savings offer flexible and locked savings options.

- How are your rewards paid out? Some lending platforms may payout directly into stablecoins. This can be helpful for tax purposes and simplify the process.

- What is the risk of the platform? As stated, there are risks. Personally, I’d feel safer with Coinbase, Binance or Gemini holding my funds, as opposed to a lending platform that is newly established.

- Can you earn better rates via holding the native token? Some platforms allow greater rates if you hold that platforms native token.

Although you can get better rates, it’s important to weigh up whether the higher marginal rate is worth spending the extra funds on the native token and there is a risk it could significantly drop in value. - How fast can you pull out your funds? Depending on who you use, it could take one day or as long as a week to withdraw your yield or principal from the platform.

- Does the APY lower if you deposit a high amount? Rates may change depending on the amount of cryptocurrency you’re lending (often greatly decreasing as you lend more cryptocurrency).

Closing thoughts

- Be cautious of having all your stablecoins in a single platform.

- If you are more risk-averse it could be best to stick with Binance, Coinbase or Gemini.

- When earning yield in stablecoins, I’d much prefer to use USDC. The certainty, transparency and regulatory clarity is a bonus for me so I much prefer to use USDC instead of USDT.

Again, I’d love to hear members’ experiences and go-to for centralised lending platforms.