It’s unclear how long cryptocurrency markets will remain down—but given the challenging market conditions, it’s essential to understand the options at your disposal during bear markets.

We dive into 4 practical tips to make the best of the market conditions and navigating a bear market.

#1 Stake or Lend Your Cryptocurrency

Stake

Staking cryptocurrency in market downturns can be a great way to put your idle cryptocurrency to work—especially if you plan on holding it medium to long term. You can either use DeFi or the convenience of a centralised platform.

Depending on which you use, you might need to ‘lock’ your cryptocurrency for a given time.

Read: Ultimate Guide To Staking

Analyst take (Nick): For example, staking your ETH (or KSM, LUNA or SOL) with Lido. With the merge coming, it’s expected ETH APY will rise from the current 4% APY to ~10%. This is because miner tips and transaction fees will 100% go to stakers.

Lend

Alternatively, you can also lend your cryptocurrency via centralised platforms or DeFi.

This might be advantageous if you’ve built up a pool of stablecoins ready to deploy but want to earn a yield on those idle assets, or you have crypto-assets that can’t be staked.

Although this may be less optimal, as demand for lending may decrease in bear markets, which could mean lower yields.

You can still earn up to 10% on USDC through different centralised exchanges (keep in mind rates will significantly reduce if you lend in higher amounts).

Read: (free Team Insight) Using Centralised Lending Platforms To Earn Yield

For those who play crypto native play-to-earn games, you may be able to earn passive income through lending out your NFT assets through ‘scholarship’ programs (such as Axie Infinity) or renting them on an open marketplace. Be careful of scams and only use official links if your game supports it.

Analyst take (Nick): If you prefer to use DeFi, a potential opportunity many people use is Achor Protocol, which offers a 20%APY on UST (Terra’s stablecoin). Although this has a much higher risk factor, the 20% APY is seen as unsustainable long term, most likely will reduce in the coming years and UST has peg issues.

#2 Take Advantage of Research

While many market participants lose interest in bear markets, it can be an excellent opportunity to focus on research and find opportunities. After all, developers continue to build despite prices going down, and capital continues to flow into the ecosystem.

It can be challenging to contend with a high valuation crypto market when there’s a bull market. As in many cases, loyal market participants planted seeds throughout 2018-2020, and high valuations mean it can be difficult to find an excellent risk-adjusted opportunity.

Bear markets are the time to research your favourite projects and pay attention when short-term thinking investors flee the market.

It can be an excellent opportunity to scope up those projects you’ve been eyeing off when all eyes are off crypto.

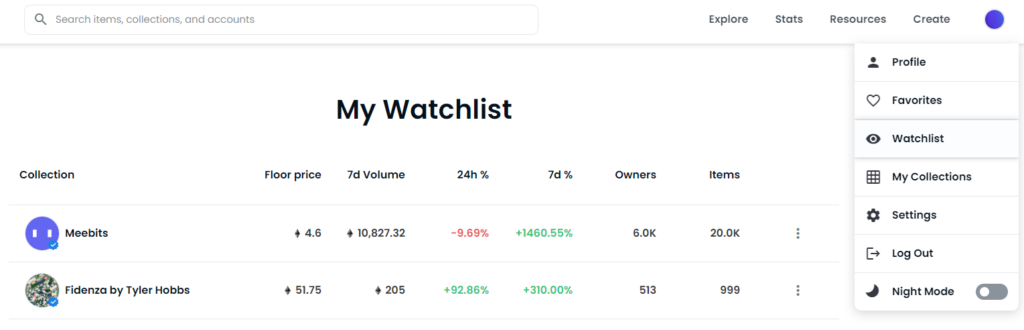

Analyst take (Nick): Make a watch list for your research

Make a watchlist to track NFTs or even crypto projects you want to own but not now. If you’re like me and want to buy more NFTs over the next year if a bear market continues or NFTs sink lower, a great way to do this is by managing a watchlist—OpenSea now allows you to add collections to your watchlist.

You can achieve the same thing with a well-organised spreadsheet or using paid tools such as NFT HUD or WGMI (requires an NFT as membership).

#3 Remember Your Long-Term Outlook

Most importantly, stick to your long-term plan.

Bear markets could make you panic or do something you wouldn’t normally do. These can be the times to double down and remember your initial goal.

There have been many discussions around ‘should I sell my altcoins ‘. This depends on your cryptocurrency, when you acquired it, and your goals. Think back to why you acquired them, your cost basis and whether you had a short term or long term view.

Analyst take (Nick): For example, I’m long ETH and have the long term mindset Ethereum can achieve its scaling roadmap, and Ethereum block space will continue to become a demanded commodity. So I’m personally not too fazed with short-term price action. It ultimately depends on your intention.

If your actions are against your long-term thesis or mindset, ask yourself what has changed?

Read (member-only): Ask Yourself Has Your Investment Outlook Changed?

#4 Dollar-Cost Average (DCA)

Depending on what stage you got into crypto or your goals, DCAing throughout a bear market could be a way to build up a base position of capital invested.

DCA is when you accumulate an investment product bit by bit, over intervals such as monthly or quarterly.

It could be an excellent opportunity to DCA into positions you have always wanted to in bear markets. Although keep in mind many cryptocurrencies are down 50-70%, and they can always go lower.