Top 3 Risks To Pay Attention To

Okay, now you are well aware of the risky nature of cryptocurrency and the fact that many cryptocurrencies may go to zero.

This is just reality.

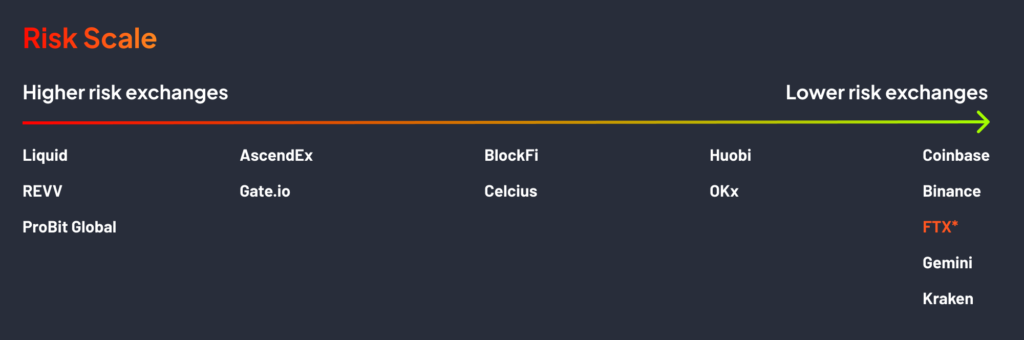

There’s an inherent risk when using exchanges or lending platforms. The level of risk depends entirely on the exchange or platform you’re using.

If these exchanges go insolvent, your crypto assets are at risk as these platforms will often not insure your funds. This is why self-custody can be so important—i.e. the act of holding your cryptocurrency in your own possession and not with an exchange.

Often, when holding your crypto with an exchange, you are giving an IOU, and you don’t really own that crypto but rather an IOU.

Scam risk is one of the most common risks in crypto. Lax security practices and crypto scams pose a significant risk that isn’t to be understated.

Unfortunately, if people know you hold crypto, you may become a target.

Remember the basics:

- If it’s too good to be true, it probably is—for example, send 1 BTC, and I’ll send back double.

- Verify you are talking to the correct customer service and not imposters

- Ensure the URL is correct by bookmarking your favourite exchange.

- Never share your seed phrase or passwords with anyone, even the exchange themselves.

- Use 2FA on your exchange amount

- Keep your recovery phrase offline

This risk increases when doing more complicated things in crypto, such as using a web wallet and crypto apps. We’ll dive more into this later!

Once you dive into smaller cryptocurrencies rug pull risk increases, and it is just as likely to steal your crypto as any hack.

A rug pull is when you purchase a cryptocurrency or NFT that promises to deliver a roadmap or project but disappears. Often taking funds and abandoning the project.

Storing your crypto outside of an exchange and in your own custody is not something to take lightly. There have been many people out there who have lost serious aunts of Bitcoin or crypto because they either?

- Forgot their password

- Lost their seed phrase

- Threw it out

- Wrote down the wrong words

- Didn’t have good security.

Lucky we have the ultimate guide to storing your cryptocurrency

We strongly recommend using a hardware wallet to store any “significant amount” of crypto.

Further risks from our Beginner Course

Risk Tolerance

Your personal risk appetite will dictate what percentage of your portfolio is allocated to cryptocurrencies in comparison to other asset classes, as well as what percentage of your cryptocurrency portfolio you allocate to specific cryptocurrencies. It’s important to perform a comprehensive risk assessment of any cryptocurrency before you consider investing, as failing to do so can significantly impact the risk-reward ratio of your portfolio.

Failure

The reality is that most cryptocurrency projects will almost certainly fail over the long-term for a variety of different reasons including (but not limited to): low user adoption, poor management, lack of innovation, technical failure or outright malicious intent. This high possibility for failure underscores just some of the reasons why investors are apprehensive to invest in cryptocurrencies and why those that do tend to be conservative with their approach and allocations.

Use Cases

We’ve covered the risks involved with investing in one industry or sector, and this same theory can be applied to the way you structure your cryptocurrency portfolio. If you own several cryptocurrencies that are all based within the same industry or designed to solve the same problem, you may be exposing yourself to unnecessary risk. For example, if the industry or sector you base all of your cryptocurrency investments no longer has a demand or need for a blockchain-based solution, the entire value of your cryptocurrency investments could be significantly impacted.