What a 48hr roller coaster. I was on an 18hr flight between Mexico and Portugal as the whole LUNA debacle unwound, and what a debacle it was.

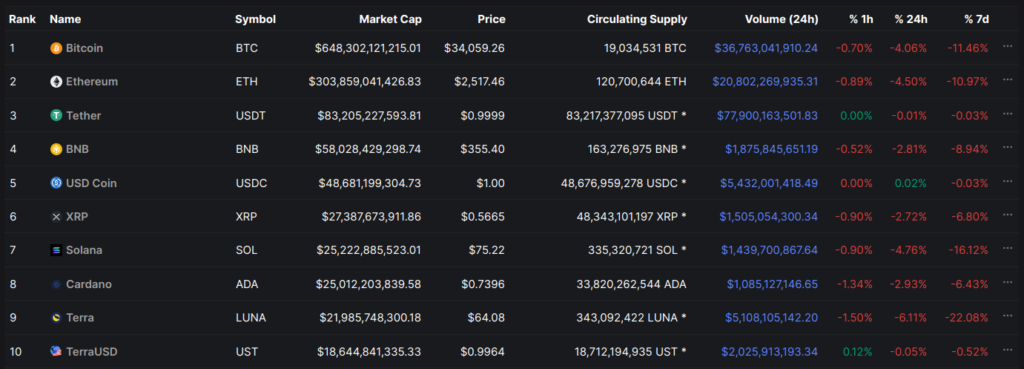

The hard reality is that this has happened many times before, where a project crypto unwinds in a bear market. The difference is that both LUNA and UST were in the top 10 and worth a combined $40.6B barely 2 days ago.

This snapshot is from 8-May

What we have here is the unwinding of a completely unstable model. I am going to put my case forward that algorithmic stablecoins are a complete farce. Like the oracle problem, it simply cannot and will not be solved without a centralised authority.

What we have here is the market recognising a weak and unstable peg system, and taking them to the cleaners. The UST:USD peg is one for the history books.

I never really looked into LUNA because my bullshit detector went off as soon as I heard about the burn mechanism. I only realised why this was the case recently, when I remembered another project with a similar mechanism that I studied a while back, Haven Protocol (video report here).

Basically, all the economics that benefit both LUNA and UST on the way up, are equally reflexive on the unwind down. This is the final state for LUNA is down from $119 to $3.58 at the time of writing.

Reality of this situation, by my assessment, is as follows:

- LUNA and UST are done for. We will probably see price bounce as speculators come in, but the project credibility is over.

- The arrogance of Do Kwon should be a red flag for the ages. I’ve never seen the Bitcoin market punish such arrogance as quickly before.

- Stablecoin and DeFi regulation is coming in hot. There is zero chance that watching $40B evaporate and ruin many retail investors doesn’t bring sweeping and aggressive regulations. This will not be constructive for DeFI at first, and I expect almost all tokens and coins to be classified as unregistered securities. KYC will likely permeate the ‘DeFi’ space, and we will discover how centralised DeFi really is.

- This is NOT constructive for L1s. In fact, coins that are not Bitcoin are in for serious pain ahead (and BTC isn’t immune to this pain either, just to a lesser extent). We probably just added 6-12months to our bear market sentence.

I know this isn’t what we all want to hear, but it is the most likely reality. I hate seeing this happen, LUNA need to die. It is better they blow up at $40B than at $400B in size.

It is in moments like this, that hardcore Bitcoin advocates are the most correct. The misaligned incentives, games, grifting scammers that permeate the altcoin space are here for one thing only: to extract as much money from clueless retail as possible, and walk away. These schemes hurt people financially, and that is uncool.

Bear markets are where this all unwinds. Where marketing fails to hide reality, and token unlocks continue, right as demand falls to near zero.

Thankfully, LUNA appears to have unloaded all of their ill-gotten Bitcoin, and now we start the process of recovery. Fear not, this market will recover, but it will take time, perseverance, and an iron stomach.

For reference, here are some good resources on what likely happened with LUNA over the last few days.