*The strategies outlined in this guide have been adopted from the equities market and have been in use since 1973[1], However, options contracts are relatively new to the world of crypto and therefore have additional risks that need to be considered – particularly when opening and closing positions. Therefore, this tool is to be used as a glossary and a guide, not investment advice.

**Screenshots of exchanges are for demonstration purposes only and do not represent a recommendation of which exchange to use.

Table of Contents

- Introduction

- Basics: Summary from Part 1

- Theta: Introduction to Greeks.

- Strategy 1: Bull call spread – Bullish, limited risk, limited profit, a debit spread.

- Strategy 2: Bear put spread – Bearish, limited risk, limited profit, a debit spread.

- Strategy 3: The married put – Bullish, limited risk, unlimited profit, debt position.

- Glossary: Bolded words or terms can be found in the glossary.

Introduction

Options are a derivative that can provide leverage, flexibility to trade in any direction, portfolio protection, or even generate monthly income. However, there is great risk* when options are misunderstood and misused.

A Summary of the Basics

There are 2 types of options contracts: calls and puts.

In its most basic form, buying a call option is to make a bet that the price of an asset will be a certain price, at a certain time, and it will give you the right to make a claim on that bet if you are right.

Specifically, the call option is a contract that gives the buyer the right, but not the obligation, to buy the underlying asset at an agreed price (strike) within an agreed timeframe (expiry).

On the other hand, buying a put contract is purchasing protection against an underlying asset you own. Or, speculatively making a bet that the underlying asset will decrease in value.

Specifically, the put option is a contract that gives the buyer the right, but not the obligation, to sell the underlying asset at an agreed price (strike) within an agreed timeframe (expiry).

There are many combinations of strike prices and time expirations for an options contract. These can be combined to make simple income-generating strategies, portfolio protection strategies, or complex investment strategies.

Part 2 of this Crypto Options Guide, focuses on simple strategies that build upon our previous knowledge. (For more on the basics, please refer to Options Guide Part 1 in Resources.)

Strategy 1: Bull Call Spread – Bullish, limited risk, limited profit, debit spread.

Strategy 2: Bear Put Spread – Bearish, limited risk, limited profit, debit spread.

Strategy 3: The Married Put – Bullish, limited risk, unlimited profit, debit position for portfolio protection.

First, we need to understand strike prices in an options table.

ATM, ITM, OTM – What Do They Mean?

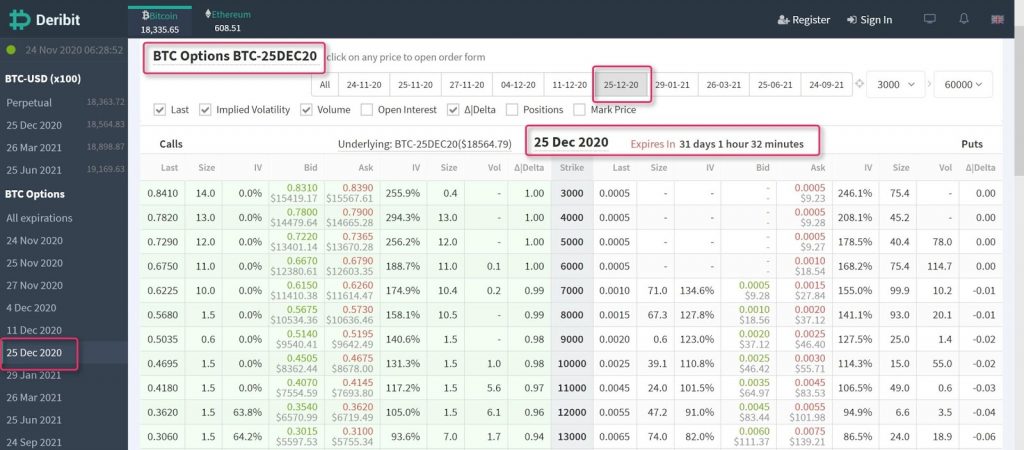

This theory is much easier to comprehend visually using an options chain (options data table).

(note: not all crypto options platforms have this form of visualisation.**)

At-the-money option (ATM): An option where the price of the underlying security is the same as the strike price. (see Figure 1)

In-the-money option (ITM): An option where the price of the underlying security is in a favourable position, relative to the strike price. For the holder of the option, this means it has intrinsic value. A call is in the money when the price of the underlying security is higher than the strike price. A put is in the money when the price of the underlying security is lower than the strike price.

Out-of-the-money option (OTM): An option where the price of the underlying security is in an unfavourable position, relative to the strike price. For the holder of the option, there is no intrinsic value. A call is out of the money when the price of the underlying security is lower than the strike price. A put is out of the money when the price of the underlying security is higher than the strike price.

As you can see, the ITM options (in green) have the most value. This is also known as intrinsic value. The benefit of viewing an options chain in this format is you can see the further away you move up the down call options chain, the greater the intrinsic value. Conversely, the further away you move up the put options chain, the greater the intrinsic value.

For example – In the screenshots above, you can see BTC is trading at $18,368. Therefore, an $18,000 call option gives you the right to buy BTC at $18,000. This means the $18,000 call has $368 of real (intrinsic) value.

However, in the example, above we can see that the actual price of the $18,000 call option is worth $1,900 (between the bid-ask of $1,877 and $1,933). So where is the rest of this premium coming from?

Theta

Theta is one of the ‘Greeks’. It is the time-value component of an options price, otherwise known as ‘extrinsic value’.

Every option is made up of these 2 values: intrinsic value and extrinsic value. The portion of each is a sum of the intrinsic value of the strike price plus the additional time until option expiration (Figure 4) and calculated with a mathematical formula.

Going back to our example, the price of the 18000 call option is worth about $1900 (between the bid-ask of $1,877 and $1,933).

Therefore:

Intrinsic value = (Underlying price – ITM Strike price)

= $18,368 – $18,000

= $368

Extrinsic value = (Option price – intrinsic value)

= $1,900 – $368

= $1,532

We can then assume the BTC Call option with a strike of $18,000 has approximately $1,500 of time value with 31 days to expiration.

All options that are out-of-the-money are only made up of extrinsic value. Since there is no real value in the price of an OTM, it is clear that time is the only premium that is left in an OTM option.

Importantly, all options that are at-the-money have the most amount of theta for their given expiration date. This will become useful to know for future strategies.

In the case of this example, there are 31 days of time value left. At this point, it would be nice to assume all options that are either ATM or slightly ITM have approximately $1,500 of time value left —this would make for easy maths and easy trading!

However, this is not the case. These prices are dynamically calculated using a mathematical formula called the Black–Scholes Options Pricing Model.

Whilst you do not need to understand this formula, you just need to be aware there are many inputs that generate the pricing output. In the examples above, the objective is to demonstrate the two most prominent and basic features of the options premium – intrinsic and extrinsic value.

Time Decay

Depending on the position, time decay can be your friend or your foe. You need to become aware of this concept as this is crucial to successful options trading and portfolio protection.

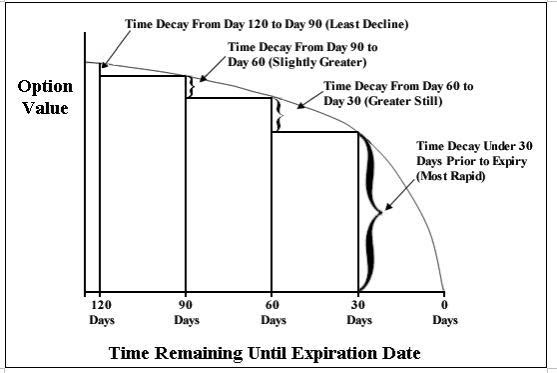

In our example, we had approximately $1,500 of time value left with 31 days to expiration. If we use the graph below (Figure 5), we can see this $1,500 time value is going to diminish fast.

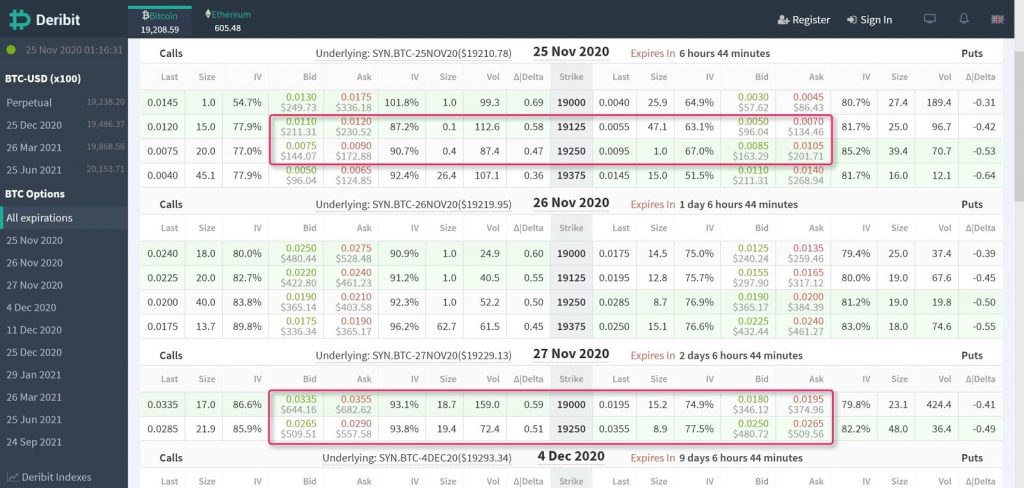

In the example below (Figure 6) we can see the options table for options that are expiring in 1–3 days. As you can see, the options closest to the money are boxed in red.

If we look at puts with a $19,000 strike, we know there is no intrinsic value because BTC is trading above $19,000. Now, if you look at the value of the $19,000 put with 2 days until expiration ($374) and compare it to the $19,000 put with 6 hours until expiration ($86). You can calculate that in 2 days, this time decay is approximately $288, which will eventually go to zero.

Generally, traders may not want to hold an OTM option until expiration. This is because options that are OTM will expire worthless and you will be losing premium (money) during the last 30 days.

Although, there can be an exception, in the case of a sudden explosion in price action, where an OTM option suddenly becomes ITM prior to expiration.

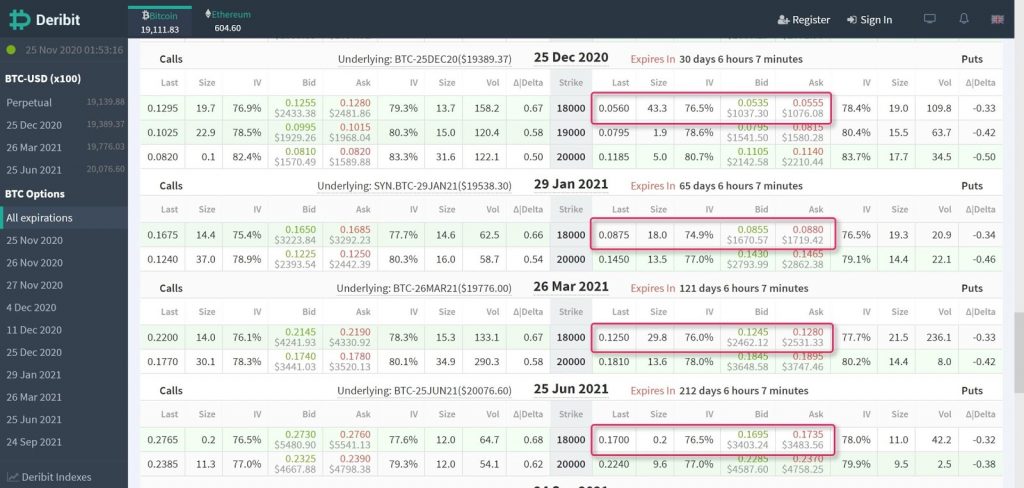

In Figure 7 below, you can see the options chain for near ATM expirations of 30 DTE, 65 DTE, 191 DTE and 212 DTE (days until expiration).

Unfortunately, the $19,000 put contract is yet to become tradable (at the time of writing). However, we will use the $18,000 strike put as an example.

Here, we know that the value of this option is only carrying extrinsic value because BTC is trading above $18,000.

Therefore, we can see a theoretical example of time decay in action:

- Jun. 25th $18,000 put (212 DTE) = $3,483

- Mar. 26th $18,000 put (121 DTE) = $2,531: $902 decay over 91 days (25%)

- Feb. 27th $18,000 Put (95DTE) = $2,125: (+/- $1,358 over 117 days or 38%) estimate only

- Jan. 29th $18,000 put (65 DTE) = $1,719: $1,764 decay over 147 days (48%)

- Dec. 25th $18,000 put (30 DTE) = $1,076: $2,407 decay over 182 days (69%)

As you can see, in this pricing table there is no February expiry. However, we can roughly assume the price of this option would be somewhere between the 121 DTE price and the 65 DTE price.

If you refer to Figure 5 and apply the time decay curve to our estimations above—all else remaining equal with the underlying price of BTC—we can estimate that the Jun. 25th $18,000 put will lose approximately $900 in the first 90 of 212 days (about 25%). In the last 95 days of 212, it would lose an estimated $2,125 (62%) of time value.

How Can We Use This Knowledge?

A basic rule of thumb is when buying to open (BTO) a position, you want to have time on your side. When selling to close (STC) a position it’s useful to do this before the time decay is the most aggressive, for example, 45-30 DTE.

Understanding time decay (Theta) will help your decision to enter strategies like the Covered Call and the Protective Collar (both covered in Crypto Options Guide – Part 1).

Theta is also an important piece of information that we can use for the next 3 strategies.

The Bull Call Spread

The bull call spread is usually the first multi-leg strategy that a new options trader will learn as it’s a spread that has limited risk but also limited profit. It’s the beginning of understanding more complex spread strategies.

The bull call spread is also known as a debit spread because the net result of purchasing a lower strike call and selling a higher strike call creates a net debit. Because of this, it’s a preferred strategy when volatility is low whilst the outlook may be bullish.

Definition

A bull call spread is an options trading strategy designed to benefit from the underlying asset increasing in price. The strategy is to purchase 2x call options to create a range (spread) between a lower strike price and an upper strike price. The bullish call spread helps to limit losses of owning the underlying, but the position also has a capped gain.

Formula

ITM Long Call – Same expiration date

OTM Short Call – Same expiration date

Net Debit = Long call premium – short call premium

Max Profit = Strike price short call – strike of long call – net debit.

Max Loss = Net debit paid for premium

Break-even = Lower strike price + net debit paid

Reward/Risk = max profit / max loss

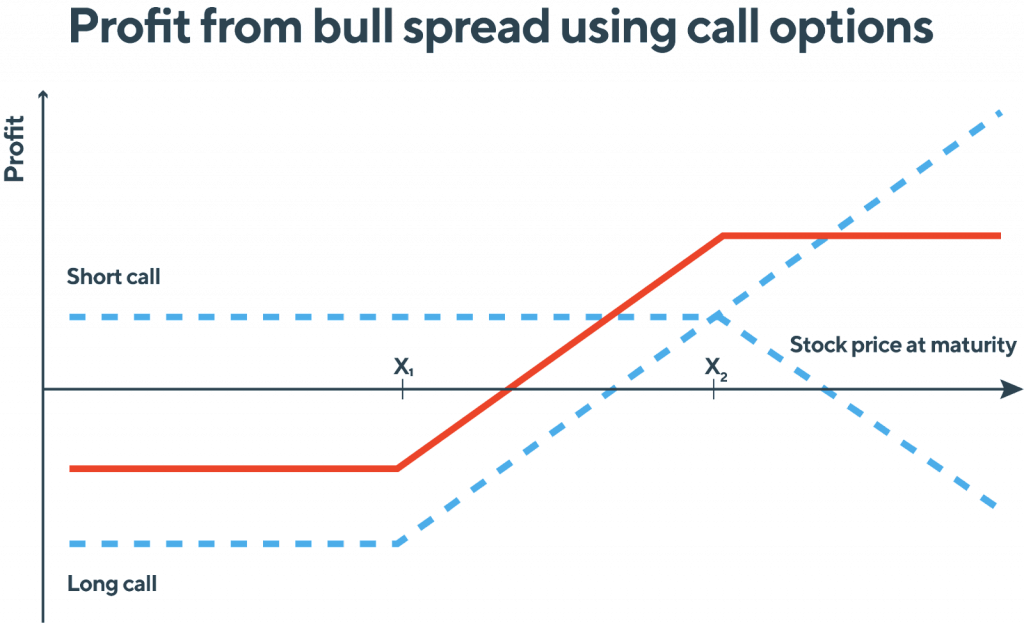

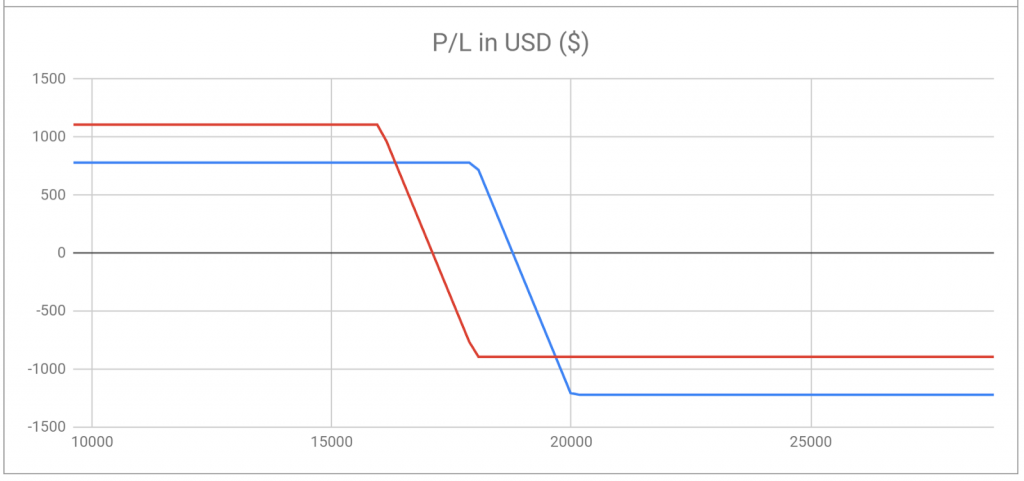

Risk Graph

By purchasing a long call, the max loss of this position begins at the cost of this debit (represented by the red line in Figure 8.1). The profit potential of this spread is then realised up until the point the underlying asset reaches your short call. The net result equals a bullish position, with limited risk and limited profit.

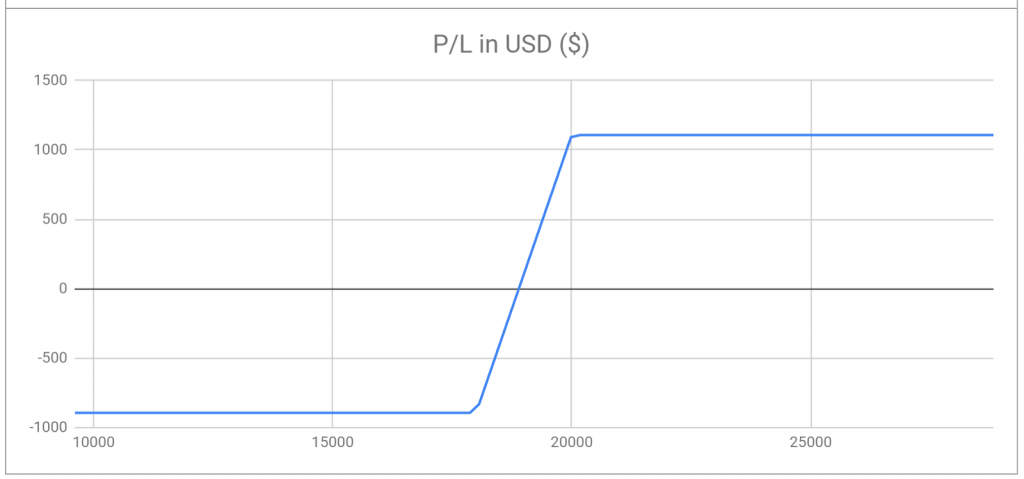

For example, if BTC is trading at $19,216, then…

Long 1x Jan. 26,all @ $18,000 = $3,045

Short 1x Jan. 26, call @ $20,000 = $2,152

Net Debit ($3,045 – $2,152) = $893

Max Profit ($20,000 – $18,000 – $893) = $1,107

Max Loss = $893

Break Even ($18,000 + $893) = $18,893

Reward/Risk ($1,107/$893) = 1.23

In this example, the reward risk ratio is not great. To increase the RR you can experiment on paper, widening the spread (creating a wider gap between the strike prices). This involves moving the legs further OTM or further ITM. Note, increasing the RR by widening the spread does not increase the probability of profit. This only is a measure of risk vs reward. You can experiment with the risk graph by using this spreadsheet calculator.

Caution: Be cautious of exercise risk at expiration. If you are unsure how your preferred platform exercises option contracts, be sure to close positions before expiration to be on the safe side.

Refer to the glossary: Exercise + European-style option + early assignment

The Bear Put Spread

The bear put spread is also a debit spread, but is the exact opposite of the bull call spread.

It’s a spread that has limited risk but also limited profit, because of the net result of purchasing a high strike price put and then selling a lower strike put. The outlook is a decline in the underlying asset price when at the time of expiration is equal to or below the lower strike price.

Definition

A bear put spread is a limited profit, limited risk options trading strategy that can be used when the options trader is moderately bearish on the underlying asset. It is created through buying a higher strike in-the-money put option and selling a lower strike out-of-the-money put option.

The options trader hopes the price of the underlying drops, maximising his profit when the underlying drops below the strike price of the written option, netting him the difference between the strike prices minus the cost of entering the position.

Formula

ITM Long Put – Same expiration date

OTM Short Put – Same expiration date

Net Debit = Long put premium – short put premium

Max Profit = Strike price of long put – strike price of short put – net debit

Max Loss = net debit paid for premium

Break Even = Long put strike price – net debit paid

Reward/Risk = max profit / max loss

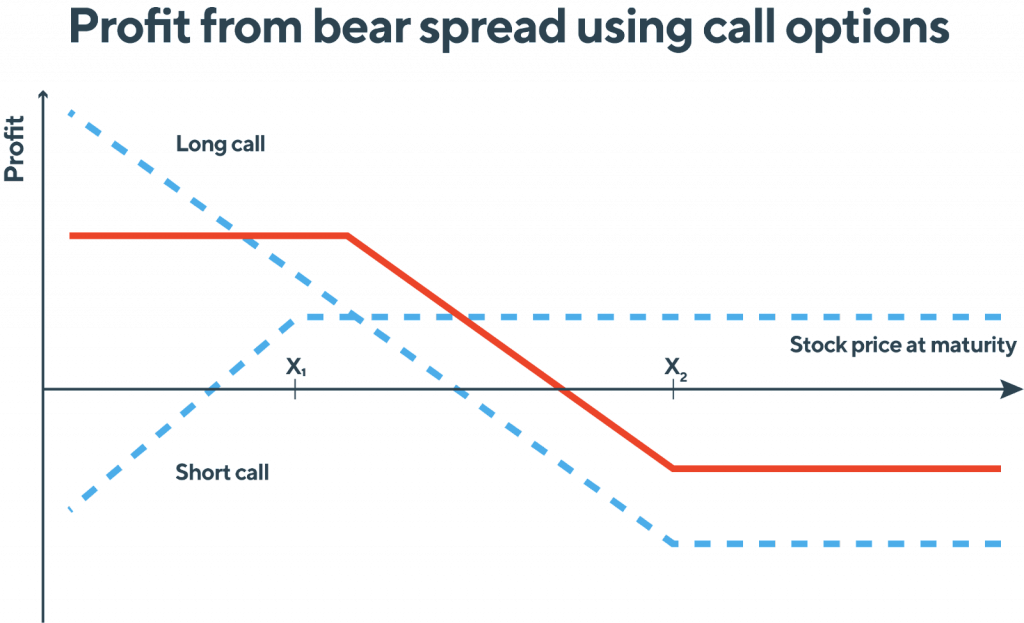

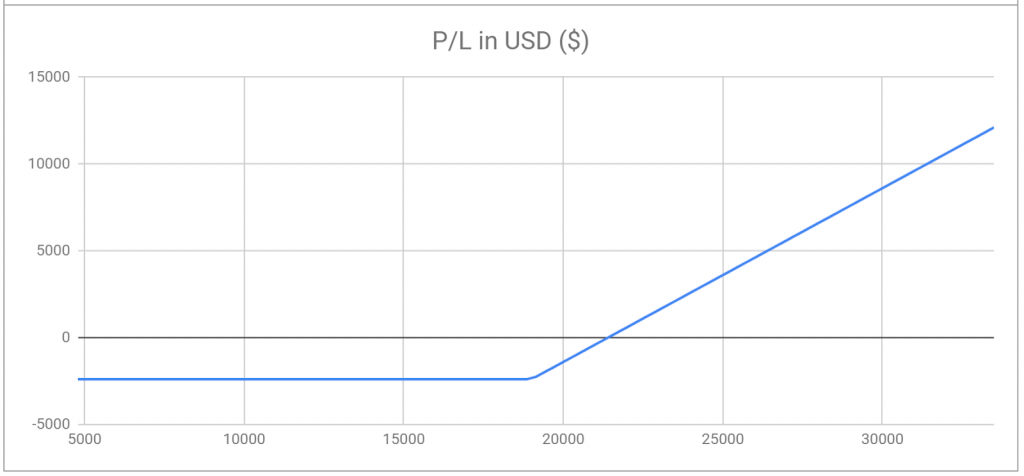

Risk Graph

In this scenario, the trader hopes to gain a small profit on the downwards price action. The max profit occurs when the price of the underlying asset is less than or equal to the strike price of short put (represented by the red line in Figure 9.1). The max loss occurs when the price of the underlying asset is greater than or equal to the strike price of the long put. The net result is a bearish position, with limited risk and limited profit.

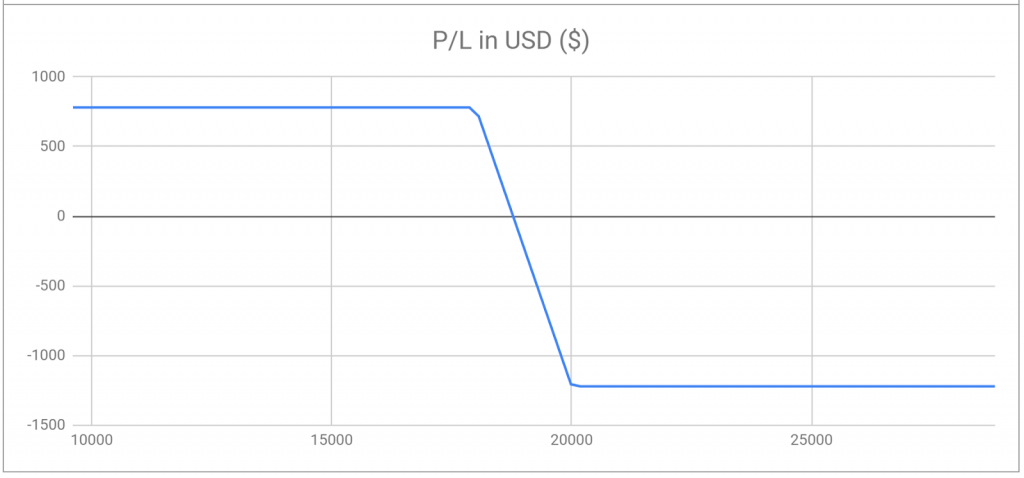

For example, if BTC is trading @ $19,216, then…

Long 1x Jan 26 put @ $20,000 = $2,949

Short 1x Jan 26 call @ $18,000 = $1,729

Net Debit ($2,949 – $1,729) = $1,220

Max Profit ($20,000 – $18,000 – $12,20) = $780

Max Loss = $1,220

Break Even ($20,000 – $1,220) = $18,780

Reward/Risk ($780/$1,220) = 0.639

In this example, the RR is not good, and the position is not in profit until a correction moves beyond $18,780. Let’s see what happens when we adjust the strike prices.

Long 1x Jan 26 put @ $18,000 = $1,815

Short 1x Jan 26th call @ $16,000 = 926

Net Debit ($1,815 – $926) = $889

Max Profit ($18,000 – $16,000 – $889) = $1111

Max Loss = $889

Break Even ($18,000 – $889) = $17,111

Reward/Risk ($1,111/$889) = 1.24

The risk graph in Figure 9.5 shows the original bear put spread (blue line) and the adjusted bear put spread (red line). With this small adjustment, we have reduced the cost basis, increased the risk-reward ratio, and increased the profit potential. However, this only is realised IF there is a bearish move in the underlying asset. Again, you must assess your assignment risk, your theta decay, and have a good understanding of the potential direction of where the underlying asset may move.

You can experiment with the risk graph with this spreadsheet calculator

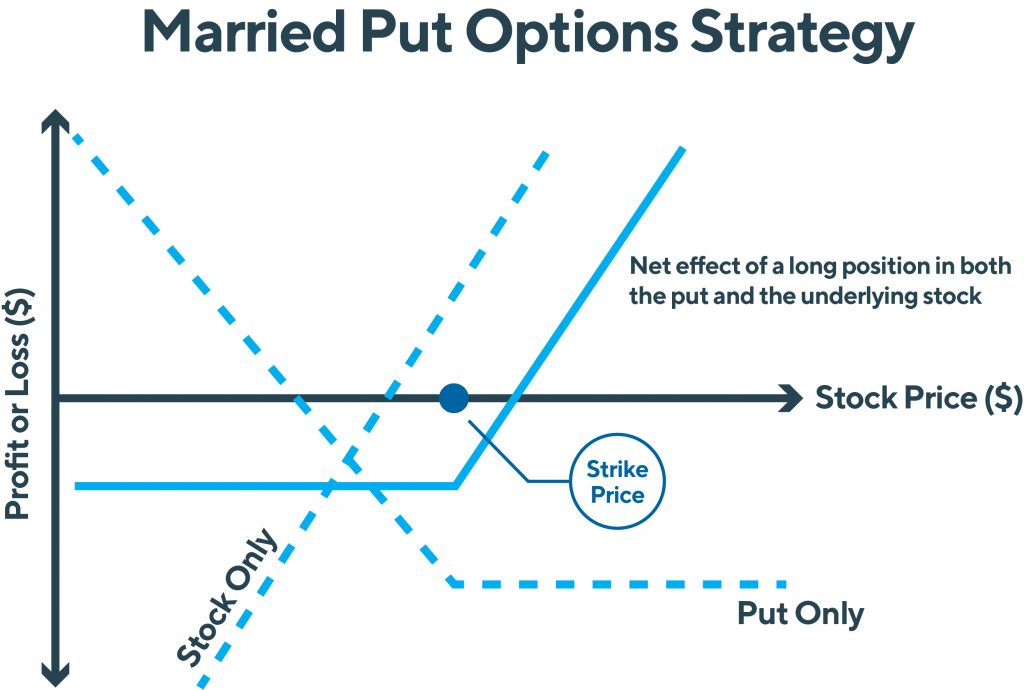

The Married Put

A married put is an options trading strategy where the investor holds a long position in an underlying asset—such as BTC—and then purchases an at-the-money put to protect against a correction of the underlying asset price.

The benefit is the trader may lose a small but limited amount of money on the underlying asset in the worst scenario, yet still participates in any gains from price appreciation. The downside risk is the put option costs a premium and its protection properties have a time limit (just like an insurance policy).

This strategy can be viewed as a cost of doing business to protect a portfolio, rather than as a speculative trade. This is because using this strategy takes constant adjustment to always remain protected against a correction. However, the benefit is you assume your total risk of the entire position when creating the position. Also noting that you can always close the position during times of low volatility or sideways action if there is still time value left in your option.

The risk graph of the married put looks much like a call option, for this reason, it is also called a synthetic call.

The horizontal blue line in Figure 10 represents the floor of protection the put contract provides. Because the put contract is married to the underlying asset, as the asset appreciates in value, the upside potential is still realised, less the premium paid for the put contract.

Married Put Formula

Profit expectation = Profit occurs when the underlying asset < purchase price of the asset + put premium.

Max loss occurs when the price of underlying asset <= strike price of long put

Maximum Profit = Unlimited

Profit = Price of asset – purchase price of the asset – put premium paid

Max Loss = Put premium paid

Break-even = Purchase price of underlying asset + put premium paid

For example, if BTC is trading @ $19,140…

You bought 1x BTC for $19,000

You buy 1x Jan. 29 put @ $19,000 strike for $2,341 debit (Put is ATM , see Figure 10.1)

Your max profit = Unlimited

Your max loss = $2,431 (11% of the total investment)

Your upside breakeven is when BTC = $21,341

Your max loss occurs when BTC <= $19,000 (Figure 10.3)

In the example above, we chose an ATM put position which equalled 11% of the total investment. When considering the married put strategy, you should ask yourself why you want to choose this method of portfolio protection, over a stop-loss on an exchange.

Some traders will choose to set their stop losses at 10% to protect their exchange portfolio, others 5% or 20%. This all depends on your appetite for risk. However, getting stopped out could push you out of a position, then causing the trader to chase a re-entry. The married put offers the same portfolio protection but keeps you in a long position in the underlying asset.

The advanced version is leveraging the ATM Bell curve and purchasing deep in-the-money put options, with long time horizons. (This is covered in Part 3).

As always, there are positives and negatives to any strategy. To get comfortable with married puts you can test the variables by using the risk graph calculator (shown in Figure 10.2) and filling out variations in the table below.

Glossary

American-style option: A contract that gives the holder the flexibility of choosing to exercise their option at any point between buying the contract and the contract expiring.

Assignment: When the writer of a contract is required to fulfil their obligations under the terms of that contract – for example buying the underlying security if they have written calls or selling the underlying security if they have written puts.

At-the-money option: An option where the price of the underlying security is the same as the strike price.

Automatic exercise: The process by which in-the-money options are automatically exercised if they are in the money at the point of expiration. In the case of European style options.

Black–Scholes options pricing model: A pricing model that is based on factors that include the strike price, the price of the underlying security, the length of time until expiration, and volatility. (Read about the Black–Scholes Pricing Model.)

Break-even point: The price or price range of the underlying security at which a strategy will break even, with no profits and no losses.

Bear spread: A spread that is created to profit from bearish movements.

Bull spread: A spread that is created to profit from bullish movements.

Buy-to-close order: An order that is placed when you want to close an existing short position through buying contracts that you have previously written.

Buy-to-open order: An order that is placed when you want to open a new position through buying contracts.

Call option: A type of option which grants the holder the right, but not the obligation, to buy the relevant underlying security at an agreed strike price.

Cash-settled option: A type of option in which any profits due to the holder at the point of exercise or expiration are paid in cash rather than an underlying security being transacted.

Contract size: The number of units of the underlying security that are covered by a contract. The typical contract size is 100. It should be noted that prices are displayed based on one unit of underlying security. So if an option is listed with an ask price of $2.00, and the contract size is 100, it would actually cost $200 to buy one contract covering 100 units of the underlying security. This is relevant to equities – Most Crypto exchanges 1 contract controls 1 unit of the underlying*

Credit spread: A type of spread that is cash positive – i.e. you receive more for writing the options involved in the spread than you spend on buying the options involved in the spread.

Debit spread: A type of spread that is cash negative i.e. you spend more on buying the options involved in the spread that you receive for writing the options involved in the spread.

Delta-neutral hedging: A strategy that is used to protect an existing position from small movements in price. This can be used to hedge existing positions in stocks or other financial instruments.

Delta-neutral trading: A strategy designed to create trading positions that will neither profit nor lose if there are small movements in the price of the underlying stock, but will return profits if the price of the underlying security moves significantly in either direction.

Delta value: One of the Greeks, the delta value measures the theoretical effect of changes in the price of the underlying security on the price of the option.

European-style option: An options contract that can only be exercised at the date of expiration and not before. These are currently in use with most crypto exchanges

Early assignment: When the writer of contracts is required to fulfil their obligations under the terms of those contracts prior to the expiration date; early assignment happens when contracts are exercised early. (American-style only)

Early exercise: When an American style is exercised prior to the expiration date.

Exercise: The process by which the holder of a contract uses their right under the terms of that contract to either buy or sell the relevant underlying security at the stated strike price.

Expiration date: The date on which a contract expires and effectively ceases to exist. Options must be exercised on or before this date, or they will expire worthless.

Expire worthless: When a contract reaches the expiration date and has no value i.e. it’s either at the money or out of the money at the point of expiration.

Extrinsic value: The component of a price that is affected by factors other than the price of the underlying security, such as time left until expiration. (Read more on Price of Options.)

Gamma value: One of the Greeks, the gamma value measures the theoretical effect of changes in the price of the underlying security on the delta value of that option. (Also referred to as Options Gamma.)

Greeks: A series of values that can be used to measure the sensitivity of an option to changes in market conditions and the theoretical changes in the price of an option caused by specific factors such as the price of the underlying security, volatility, and time left until expiry. (Read more about the Greeks.)

Hedge / hedging: An investment technique used to reduce the risk of holding a specific investment. Options are commonly used as hedging tools: protecting another’s existing position or a position in another financial instrument such as stock.

Implied volatility: Often abbreviated to IV, it’s a measure of the estimated volatility of the price a financial instrument at the current time.

In-the-money option: An option where the price of the underlying security is in a favourable position, relative to the strike price, for the holder: meaning it has intrinsic value. A call is in the money when the price of the underlying security is higher than the strike price and a put is in the money when the price of the underlying security is lower than the strike price.

Intrinsic value: The component of a price that’s affected by the profit that is effectively built into a contract when it’s in the money – i.e. the amount of theoretical profit that could be realised by exercising the option.

Leg: When an options position is made up of a combination of multiple positions, each of the individual positions is known as a leg.

Legging: The process of entering or exiting a position that is made up of a combination of multiple positions by transacting each position individually. (Read more about Legging.)

Legging in: See Legging; the process of entering a position using legging.

Legging out: See Legging; the process of exiting a position using legging.

Long straddle: The long straddle is an options strategy involving the purchase of a call and a put option with the same strike. The strategy generates a profit if the stock price rises or drops considerably.

Long strangle: The long strangle is an options strategy resembling the long straddle, the only difference being that the strike of the options is different: an investor is buying a call with a higher strike and a Put with a lower strike. The strategy generates a profit in case the stock price rises or falls significantly by the expiry date. The Strangle is cheaper than the straddle.

Married put: A position where the investor owns the underlying asset and purchases an ATM put to protect against a downside move in the price action of the underlying asset.

Margin: Margin has multiple meanings depending on the context that it’s being used. Margin related to buying stocks is the process of borrowing capital from a broker to buy stocks. Margin related to options trading is the amount of cash required to be held in a trading account when writing contracts.

Naked option: Also known as an uncovered option, this is where the writer of a contract doesn’t have a corresponding position in the underlying security to protect them against unfavourable price movements. For example, writing calls without owning enough of the underlying security is writing naked options or taking a naked position. (Danger: high-risk position.)

Near-the-money option: An option where the price of the underlying security is very close to the strike price.

Neutral trading strategies: Strategies that can be used to profit from the price of a financial instrument not moving, or moving only slightly.

Option / Options Contract: The right to buy or sell a specified underlying security at a fixed strike price within a specified period of time.

Out-of-the-money option: An option where the price of the underlying security is in an unfavourable position, relative to the strike price, for the holder: meaning it has no intrinsic value. A call is out of the money when the price of the underlying security is lower than the strike price and a put is out of the money when the price of the underlying security is higher than the strike price.

Premium: A term that can be used to describe the whole price of an option or the extrinsic value of an option.

Risk graph: A graph used to illustrate the risk to reward ratio of a position. (Read more about Risk Graphs.)

Risk-to-reward ratio: An indication of how much risk is involved in a position in relation to the potential rewards or profits.

Rolling down: The process of closing an existing position and opening a comparable position at the same time, but with a lower strike price.

Rolling forward: The process of closing an existing position and opening a comparable position at the same time, but extending the time left until expiry.

Rolling: A trading technique used to close an existing position and open a similar one at the same time, with slightly different terms.

Rolling up: The process of closing an existing position and opening a comparable position at the same time, but with a higher strike price.

Sell-to-close order: An order that’s placed when you want to close an existing long position through selling the contracts you have previously bought.

Sell-to-open order: An order that’s placed when you want to open a new position through writing new contracts.

Settlement: The process by which the terms of a contract are resolved when the option is exercised.

Spread: A position that’s created by buying and/or selling different contracts on the same underlying security to combine multiple positions into one effective position. (Read more about the Types of Options Spreads.)

Spread order: A type of order that’s used to create a spread by simultaneously transacting all the required trades.

Strike price: The price specified in a contract at which the holder of the contract can exercise their option. The strike price of a call is the price at which the holder can buy the underlying security and the strike price of a put is the price at which the holder can sell the underlying security.

Theoretical value: The value of a specific option, or position, that is calculated by a pricing model or other mathematical formulas.

Theta value: One of the Greeks, the theta value measures the theoretical rate of time decay of that option.

Time decay: The process by which the extrinsic value diminishes as the expiration date of the option gets closer.

Vega value: One of the Greeks, the vega value measures the theoretical effect of changes in the implied volatility of the underlying security on the price of the option.

Volatility skew: When a graph that represents the implied volatility across options with the same underlying security, but different strike prices form a curve skewed to right.

Volatility: A measure of how a financial instrument is expected to fluctuate over a specified period of time.

Weekly option: A type of option that uses a weekly expiration cycle.

Writer: The creator of new contracts to sell.

Writing an option: The process of effectively creating new contracts to sell.

[1] CBOE Research

A special thank you to Collective Shift Crypto Community member, Dave, for putting together the content for this crypto options guide.