Impermanent loss is a new type of risk liquidity providers face when depositing assets to multi-sided liquidity pools. Impermanent loss is best described as the opportunity cost of providing liquidity to a liquidity pool instead of holding the assets.

A Worked Example

When providing liquidity to a liquidity pool, the liquidity provider usually deposits two assets to the pool. Impermanent loss primarily occurs when the two tokens are a volatile pair, meaning one token experiences dramatic price swings compared to the other token.

For example, let’s pretend we are providing liquidity to a 50/50 Uniswap pool containing DAI and Imaginary Token. At the time of providing liquidity, Imaginary Token is priced at $1,000. We decide to provide $1000 worth of value to the liquidity pool. Because it is a 50/50 pool, we will supply 500 DAI ($500) and 0.5 Imaginary Token ($500) to the pool.

Traders will be using the pool as liquidity to exchange DAI for Imaginary Token and vice-a-versa, meaning token amounts in the pool aren’t fixed and depend on token prices.

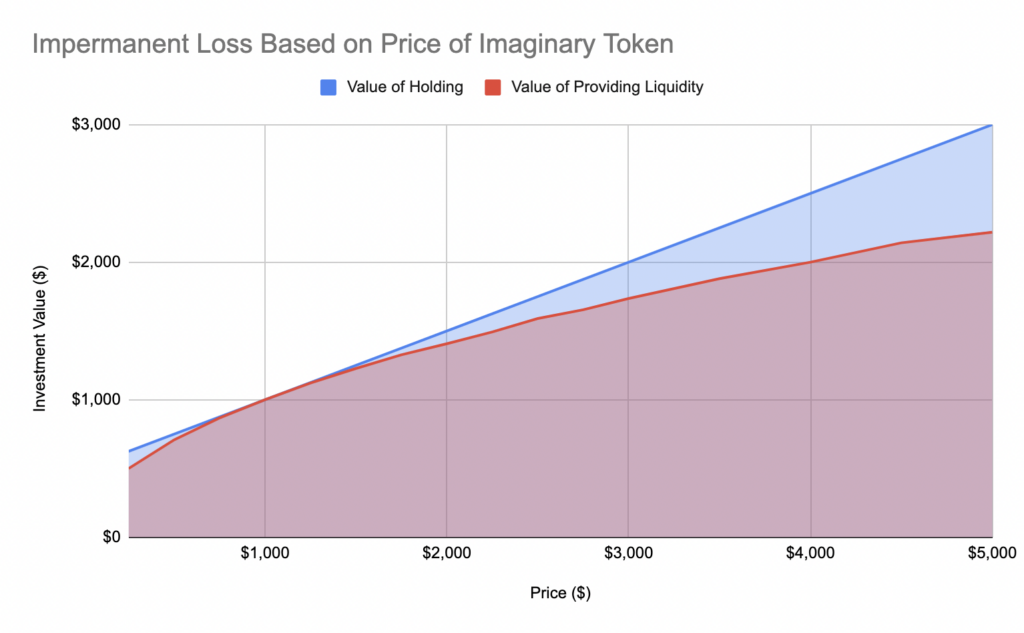

Let’s say, after 12 months, we decide to remove our liquidity from the pool. At the time of the removal, DAI held its peg of $1, and Imaginary Token appreciated to $5,000. The volatility in price between DAI and Imaginary Token has led to impermanent loss because our liquidity will now primarily be denominated in DAI.

Using Uniswap’s constant pricing function, we can estimate the token amounts we will receive when withdrawing our liquidity.

Based on the constant pricing function we can expect to receive: 1,118 DAI ($1,118) and 0.22 Imaginary Token ($1,118) for a total value of $2,236. Comparing this value to the hypothetical value of the assets had we not provided liquidity displays with the concept of impermanent loss. If we hadn’t provided liquidity, we would have 500 DAI ($500) and 0.5 Imaginary Token ($2,500) for a total value of $3,000. As we can see, we have an impermanent loss of $767 ($3,000 – $2,236).

Why is it Called Impermanent Loss?

Impermanent loss is labelled as ‘impermanent’ because it can hypothetically be recouped if asset prices return to their previous values. The loss becomes permanent once you withdraw your liquidity and cannot be recouped without making additional trades or investments.